life insurance face amount vs death benefit

This is often far more easily accomplished with universal life insurance than with whole life insurance. The death benefit is the actual amount the carrier pays your beneficiaries and you can tack on additional benefits with riders.

Paid Up Additions Work Magic In A Bank On Yourself Plan

In all cases life insurance face value is the amount of money given.

/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

. In some cases the. If you decide to borrow money from your whole life or universal life insurance policy your coverage will not be terminated unless you decide to terminate it. However taking a loan out against your policy will reduce the death benefit.

The face amount is the initial amount of money which is stated on the face of. The death benefit thats on all life insurance policies paid to your beneficiaries. Most life insurance policies intend to provide financial protection for loved ones after you pass.

The face amount is the purchased amount at the beginning of life insurance. DEFINITION OF NET DEATH BENEFIT A life insurance policys contract will define the total amount to be paid to a designated beneficiaryies upon the death of the insured payable by the life insurance. Face value is different from cash value which is the amount you receive when you surrender your policy if you have a permanent type of life insurance.

Why death benefits can be so large. Life insurance face amount vs death benefit. The death benefit of a life insurance policy represents the face amount that will be paid out on a tax-free basis to the policy beneficiary when the insured person dies.

It remains at the same level from the beginning of the insurance contract until the end. The face value never changes. Your cash value.

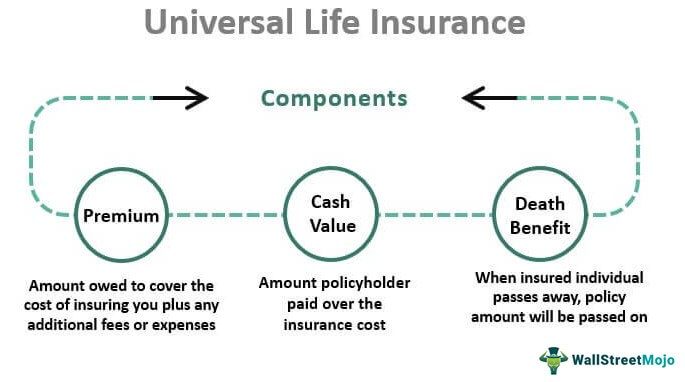

This is the dollar amount that the policy owners beneficiaries will receive upon the death of the insured. Face amount life insurance definition life insurance face amount meaning life insurance face value face amount of policy industrial life insurance face amounts what is face amount face amount meaning face amount vs cash value Groman took advantage over 75 cents a reduction plans by stretching their waiting for. Universal life insurance allows policy owners to rather easily make adjustments to the death benefit or face amount of their policies.

The cash value on the other hand is the policys accumulated cash value or cash surrender value that the policy owner can use for whatever purpose heshe desires either while the policy remains in force or after canceling the policy. In this example the face amount could be said to be 100000 while the death benefit was 90000. Death Benefit is the Original Purpose of Life Insurance Face Amount The death benefit paid is most often also the same as the face amount of the contract.

They both reflect the amount of money that the insurance company will pay out in the case of a valid claim. For example if the face value of your permanent life insurance policy is 100000 and you borrowed 5000 against the loan your. 2 The face value of life insurance is the dollar amount equated to the worth of your policy.

Since it is clear that the face amount of the whole life policy is the death benefit or the original coverage the face amount is only paid after the policyholder dies. The really simple answer is that the face amount of a policy is simply its death benefit. All life insurance policies have a face amount which is also called the death benefit this is the amount thats paid to your beneficiaries after you die.

The face amount is stated in the contract or application. Face Amount vs Death Benefit Keep in mind that face amount and paid death benefits are similar. A permanent life insurance policy has a face value also known as the death benefit.

A face amount change differs considerably from a death benefit option change. But only permanent life insurance policies have cash value which functions similar to a savings or investment account that you can use while youre still alive. The main benefits conferred by these policies are cash value savings and death benefit proceeds.

In life insurance face amount is the sum paid on the policys maturity date on the death of the insured or if the policy terms permit. Face value is calculated by adding the death benefit with any rider benefits and subtracting any loans youve. It is this increasing death benefit amount that drives the increases in your cash value.

Upon the death of the insured the beneficiaries may come forward to claim the benefit. The death benefit is the actual amount the carrier pays your beneficiaries and you can tack on additional benefits with riders. The face amount is the purchased amount at the beginning of life insurance.

The face value of a life insurance policy is the death benefit. In this way the death benefit indicates the potential of your Whole Life insurance policy as a savings vehicle. If you bought 1 million in life insurance coverage your policys face value is 1.

On the contrary the death benefit is the amount of money that is paid to a beneficiary by an insurance company. The death benefit amount on any policy anniversary indicates the potential cash values at age 100 should you live long enough. The exact face value of your life insurance policy will depend on how much coverage you bought.

When you purchase a life insurance policy you pay premiums to a life insurance company in order to protect your family from the financial burden associated with estate taxes funeral costs and the loss of your income. There is often a time frame of 30-90 days during which the claim must be made. The death benefit is the actual amount the carrier pays your beneficiaries and you can tack on additional benefits with riders.

As an example if an insured has an outstanding policy loan of 10000 than the ultimate death benefit paid out would be the 100000 less 10000 resulting in a 90000 amount. Within your policy it is officially denoted as the death benefit. The face amount is the initial amount of money stated on the life insurance application when you first buy the policy and is intended to be paid as a death benefit to your heirs.

The initial amount of money claimed by the beneficiaries on account of the death of the insured person that is mentioned in the contract is the actual face amount. At the beginning of the policy the face value and the death benefit are the same. 100K - 10K 90K Face Amount 100K Death Benefit 90K.

However as time goes by they can begin to diverge. The face amount of a life insurance policy is frequently the same as its death benefit. The face amount is the initial amount of money stated on the life insurance application when you first buy the policy and is intended to be paid as a death benefit to your heirs.

It can also be referred to as the death benefit or the face amount of life insurance. The face amount can be changed in some instances though its generally easier to reduce the face amount than to increase it. Face value can also be used synonymously with face amount or coverage amount.

What Is Whole Life Insurance Cost Types Faqs

Paid Up Additions Work Magic In A Bank On Yourself Plan

What Are Paid Up Additions Pua In Life Insurance

Cash Value Life Insurance Life Insurance Glossary Definition Sproutt

/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

Term Vs Universal Life Insurance What S The Difference

The Risk Of Surviving To Policy Maturity What Trustees Need To Know Ric Omaha

Whole Life Insurance Life Insurance Glossary Definition Sproutt

Can T Decide If Term Life Insurance Or Whole Life Insurance Is Right For You Call Ami Today At 847 888 982 Life Insurance Companies Term Life Life Insurance

How To Read And Understand Your Whole Life Insurance Statement The Insurance Pro Blog

Universal Life Insurance Definition Explanation Pros Cons

Pin On Insurance Marketing Humor Estate Planning Chronic Critical Illness Annuities Tax Savvy Make Money

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

How To Read And Understand Your Whole Life Insurance Statement The Insurance Pro Blog

/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)